Company Snapshot

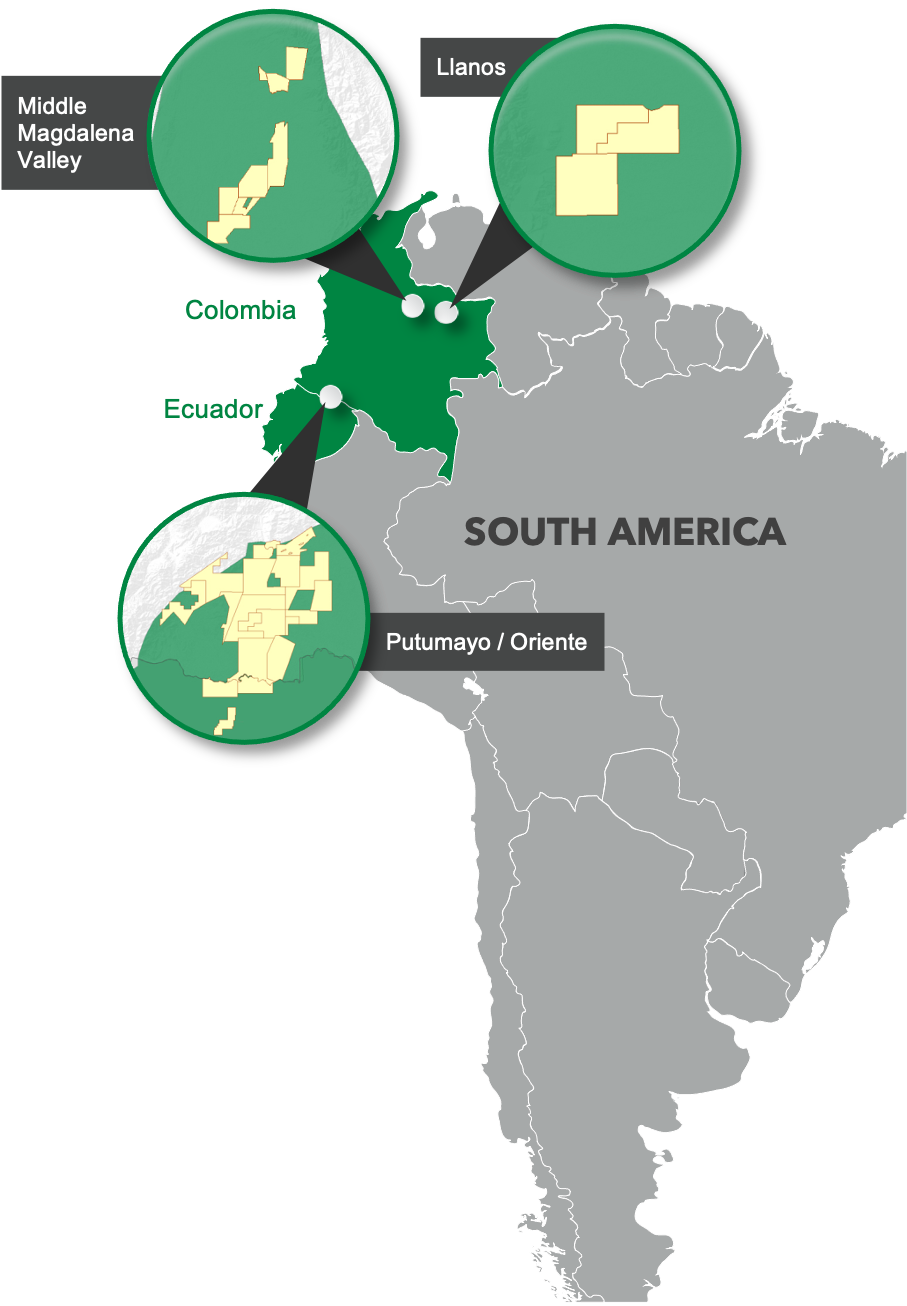

Gran Tierra is a publicly listed, independent international exploration and production company with onshore oil production focused in Colombia and Ecuador.

Colombia represents 99% of our production with oil reserves and production mainly located in the Middle Magdalena Valley (“MMV”) and Putumayo Basin. In MMV, our largest field is the Acordionero Field, where we produce approximately 17° API oil, which represented 52% of total Company production in 2022. The Putumayo production is approximately 27° API for Chaza Block and 18° API for Suroriente Block, which represented 25% and 14% respectively of total Company production in 2022.

Gran Tierra believes in creating value for all of our stakeholders through oil and gas exploration and production, capitalizing on the global operating experience of our team. We are building a record of success in Colombia and Ecuador in a transparent, safe, secure and responsible way.

GTE Uniquely Positioned for Value Creation

- Sustainable business model with significant value in booked reserves base

1P reserves underpin value; clear path to 2P and 3P exploitation; world class hydrocarbon basins - Gran Tierra offers many exciting catalysts for 2023, while building off a successful year in 2022

- Disciplined financial strategy; prudent discretionary capital programs

Focused on debt reduction, long-term value creation - World class development and low risk exploration in four proven onshore basins

Extensive seismic and well data across expansive acreage position - Going Beyond Compliance

Meaningful and sustainable impact within the communities where we operate, with a continued focus on reducing emissions

| Operating Statistics | |

|---|---|

| W.I. Production (Q3 2023) | 33,940 BOPD1 |

| 2023 W.I Reserves Metrics2 | |||

|---|---|---|---|

| 1P | 2P | 3P | |

| MMBOE | 94 | 150 | 212 |

| RLI (years)2,3 | 8 | 12 | 17 |

| NPV10 BT * (US $bn) | $2.2 | $3.3 | $4.5 |

| NPV10 AT* (US $bn) | $1.4 | $2.0 | $2.7 |

| NAV10 BT*/share (US$) | $49.55 | $84.93 | $119.81 |

| NAV10 AT/share (US$) | $27.28 | $45.54 | $64.53 |

Gran Tierra Energy utilizes waterflood technology as a secondary recovery method. All of Gran Tierra’s assets currently under waterflood greatly exceed success factors as per Willhite’s waterflood screening criteria.5 Gran Tierra’s assets rank as world-class candidates for waterflooding.

| GRAN TIERRA ASSETS UNDER WATERFLOOD6 | |||||

|---|---|---|---|---|---|

| Factors Favorable for Waterflooding5 |

Acordionero | Costayaco | Moqueta | Cohembi | |

| Initial Oil Saturation | > 40% | 78% | 86% | 78% | 90% |

| Oil-Zone Thickness | > 15 ft | 330 ft | 114 ft | 160 ft | 125 ft |

| Permeability (Average) | > 10 mD | 750 mD | 225 mD | 275 mD | 2,500 mD |

| Reservoir Depth | > 1,000 ft | 8,000 ft | 8,400 ft | 3,150 ft | 9,100 ft |

| Viscosity | < 15,000 cP | 230 cP | 1.5 cP | 3.6 cP | 28 cP |

1 Colombia W.I. Q2 2023 average production.

2 Based on shares outstanding at June 30, 2023 of 33,287,055 net debt of $503 million and GTE McDaniel June 30, 2023 Reserves Report. See appendix for McDaniel Brent oil price forecast.

3 Calculated using average Q2 2023 WI production of 33,719 BOEPD.

5 Willhite. Paul G. Waterflooding. SPE Textbook Series Volume 3. Society of Petroleum Engineers. Richardson, Texas. 1986, p. 112.

6 Based on GTE McDaniel December 31, 2022, Reserves Report.